Table of Content

NOVA Home Loans will contact you about 30 days before your forbearance ends. A 1098 Mortgage Interest statement is required if an amount of $600.00 or more is paid towards mortgage interest. For loans that meet this requirement, NOVA Home Loans is required to generate and mail statements to borrowers no later than January 31st each year. First, check out the Better Business Bureau for any complaints filed against a company you’re interested in. You can also do a Google search for the company's name along with terms like “fraud” or “scam.” This will bring up relevant news articles if there are any.

We recommend coverage solutions from insurance companies that include backup of sewers and drains. Also, identify cost efficient solutions to address the risk of flood damage in the first place. If the above options are not workable for your situation, you may be eligible to add your forbearance amount to your loan balance and modify your loan terms to make your monthly payments more affordable. Be certain that you extend the liability coverage under your homeowners policy to include your secondary home. You should also consider including the secondary home under an excess liability or umbrella policy to provide for additional liability limits. Your homeowners policy should include medical expenses coverage to take care of injuries and treatment - generally not of a serious nature.

Other types of insurance

Nova Insurance Group is an independent insurance agency offering a comprehensive suite of insurance solutions to protect you from the unexpected. If you are a connoisseur of wine, you know that it is susceptible to outside environmental exposures that can ruin it. If the collection is damaged, coverage from your homeowners policy is a possible recourse.

Make sure your homeowners policy includes replacement cost coverage for personal property so that you always receive the full cost to replace whatever item is damaged. Some states allow mortgage servicers to maintain a cushion—or additional funds—to help offset a large shortage on the escrow balance should tax and/or insurance premiums increase significantly. Your servicer is responsible for the timely and accurate payment of all escrow items. Another alternative to foreclosure is called deed in lieu of foreclosure .

About Nova Insurance Group

And finally, don’t be afraid to ask your agent or broker questions. They should be happy to go through any concerns you might have and should never coerce you into purchasing a policy. In Nova Scotia, the Office of the Superintendent of Insurance regulates the insurance industry and offers assistance to consumers on insurance related matters. The OSI has the power to investigate insurance companies and brokers’ actions.

We were established in 1999, and have become one of the largest independent agencies in Arizona. With a staff of knowledgeable insurance agents and client service team members, we are always ready and able to provide excellent service to our clients. As an independent agency we are able to work with many of the leading insurance carriers to custom design your insurance program. Let us help protect your most prized possessions with insurance that fits your priorities and budget.

Save

In the event a person is injured on your property and requires medical attention, you would be able to submit the injury-related medical expenses to your insurance carrier. Medical expenses are usually paid without a liability claim being filed against you. Make sure your homeowners policy contains replacement cost coverage with no cap. This protects you if the cost to reconstruct your home is higher than your current limit of coverage.

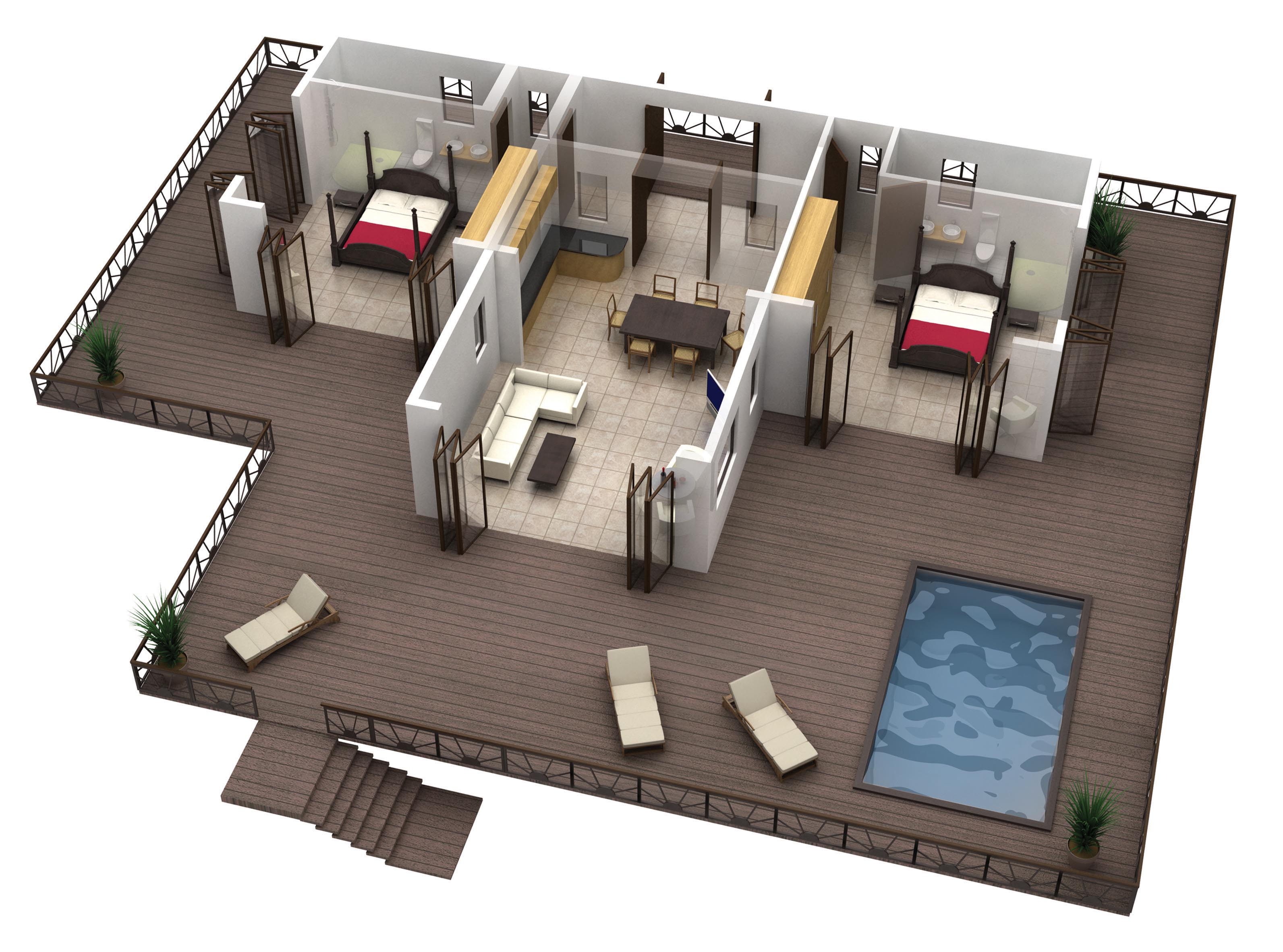

You can also consider unique coverages for wine, such as for spoilage. When your home suffers damage due to an unexpected event, your personal property is also at risk. Furniture, appliances, clothing, electronics, and other personal items can also be damaged or destroyed. Explore our interactive graphics and learn about your unique risks and the related insurance solutions. Our clients are the most important part of our agency, and we always go the extra mile to exceed all expectations.

What does home appliance insurance not cover?

Comprehensive - This policy gives you complete coverage for your dwelling and the contents inside for the majority of perils. It’s the most expensive option you can purchase but it will also give you the most peace of mind. Your home insurance policy will be customized to suit your needs and the property you’re insuring.

Basic or Named Perils - This policy will cover the home and its contents from specifically named perils in the policy. Your insurance agent can guide you toward a more lenient insurer. Another good place to start is to compare rates — you’ll immediately be able to see the spread between premiums. Get the protection you need to give you peace of mind on the road. We are the number one stop in Southern Arizona for homeowners, auto, commercial and group health insurance. As an independent agency, we offer multiple options at competitive prices.

Depending on your policy, your insurance will also pay to replace your home’s contents, including items like furniture, electronics, clothing, jewelry, and more. Home insurance does not reimburse policyholders for the market value of the home. Insurers only contribute toward the cost of rebuilding the structure using comparable materials.

And, be sure that your insurance includes rebuilding your home to code. Very often, local ordinances and building codes change over time, which may require additional costs. Also known as a forbearance plan, this offers you the ability to temporarily suspend or reduce your monthly payments for three months . Depending on the length of your COVID-19 hardship, your forbearance plan may be extended for up to a total of 12 months. If you’re facing a long-term hardship, we can review your situation for a loan modification to determine if more manageable terms are available. Unlike refinancing, which replaces your existing loan with a new one, loan modification keeps your existing loan and changes its terms.

Home appliance insurance covers the cost to repair or replace single or multiple devices in your home that are not older than 10 years. By taking out extra cover for your appliances, you can make sure the cost and inconvenience to your busy life are kept to an absolute minimum. And in the event that something goes wrong, you are assured that a network of certified experts with specialist knowledge will be available to help you. Cleanup coverage if gas, oil or other pollutant is accidentally spilled on your property. We do not cover general wear and tear on your home that is due to maintenance issues or pre-exiting conditions such as damp and rot. Claims for emergencies that occur within 14 days of taking out your policy will also not be covered.

NOVA Home Loans will not report negative data to credit bureaus or assess late fees for customers actively performing on forbearance plans , or long-term assistance options. Pay all forbearance amounts over time by adding an agreed-upon extra amount to your normal monthly mortgage payments. A copy of the new homeowner’s insurance declaration page needs to be sent to the servicer of your loan. You can also reach out to NOVA at We will gladly update this information for you. Another detail that consumers overlook is the company’s risk pool.

No comments:

Post a Comment